Using Benchmarking to Gain Insights to Improve Operating Performance.

How do you know if your plant is a marginal performer or world-class? How do you measure success? What does “good” look like? The use of metrics can help answer these important questions.

Successful businesses compare their individual performance to defined standards. These standards might be as simple as understanding if revenues were higher than expenses in the prior month, or as complex as a patented optimization metric combining the integration of diverse business metrics.

Energy: The Single Largest Opportunity to Improve Operating Costs

The most complete answer to these questions can be found through benchmarking. Benchmarking is a snapshot in time that compares facts from an asset’s operation against a database of facts from the operation of similar assets. Sounds simple, right? The challenge in benchmarking is that the standards are always moving. For example, if you are the lowest cost provider of a service or product, someone will always be trying to innovate and replace you as the lowest-cost provider. So how does this apply to the energy business, specifically the power generation business supporting a refinery?

Even the world’s best refiners are always searching for the next area for improvement to maintain or advance their relative position in the industry. Participants in the Solomon Worldwide Fuels Refinery Performance Analysis (Fuels Study) represent 85% of the world’s refining processing capacity. This participation highlights the desire of most refiners to continually improve their processes, including energy processes, to be the best operating plant possible. Energy is the single largest category of operating costs in the refining process. Average energy use as a percentage of operating cost of refineries is 28% in the North America region, 45% in Europe, and 59% in the Asia/Pacific region. Refiners pay close attention to the cost of the fuels they use and the efficiency with which they convert fuels.

Refinery Cogen Plants Offer Chance to Improve Overall Plant Performance

An area most refiners can dig a little deeper into is the operation of their cogen and onsite high-efficiency power plants. Refiners typically construct power generation assets to meet a specific purpose. The cogen asset may be designed as a baseload supply source for most (if not all) electricity and steam used by the refinery. A cogen plant may also be designed as a ready backup supply of power and steam, operated sparingly. The design of the cogen plant can lie anywhere between the two extremes in operating roles.

The operating role for each refinery’s power cogeneration assets can change as the environment in which it operates changes. As an example: A refinery may be built near a hydroelectric dam and power plant with cheap electricity. The cogen asset is unlikely to produce power as inexpensively as the outside market can supply it and maybe running to primarily supply thermal energy (steam/hot water) to support the processing unit(s). But what happens when this same refinery finds that during an El Niño/La Niña event that water is scarce, or that the area around it has grown such that power demand now outstrips the hydroelectric supply and gas-fired plants now set the price for power? The refinery cogen was designed to be a backup supply, but now might be a lower cost option for the refinery’s electrical energy needs. The cogen in this scenario is now in a market position where it operates more like an independent power producer. The operating and maintenance strategies and costs for these examples for the same plant asset are very different. The change from one role to another can be subtle or abrupt. How can a refiner know they are investing the right amount in the right place to maintain the desired availability of the cogen plant?

Power Study Can Provide Guidance on Becoming World’s Best Operator of Refinery Cogen Plant

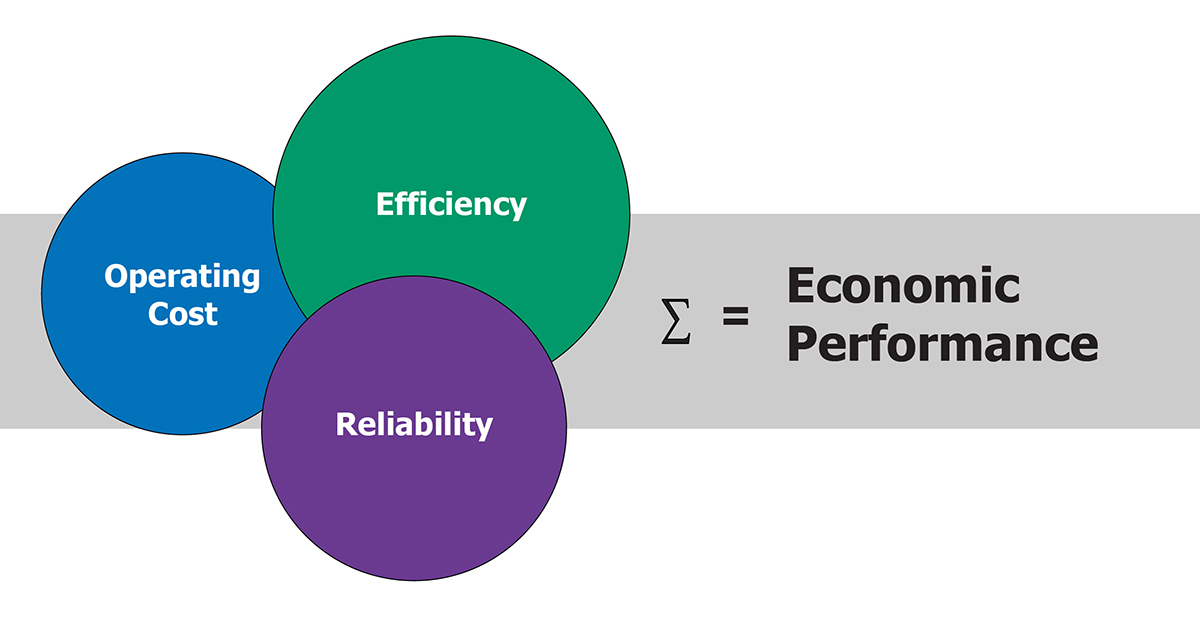

Participation by cogens in the Solomon Worldwide Power Generation Performance Analysis (Power Study) is an excellent way to evaluate your plant’s current performance and develop strategies for you to become the world’s best operator of a refinery cogen plant. The Power Study will evaluate the process efficiency, reliability, and operating costs of your cogen asset as an independent power plant. The study can identify and quantify the differences between your facility and the top-performing facilities worldwide in terms of production losses, thermal efficiency, and spending; it can then show you where you can improve your plant’s performance.

Started in 1997, the Power Study has the world’s largest detailed database of operating thermal power plants. It provides participants not only with tools and unique analysis techniques but the insight of Solomon’s consultants, who have an average of more than 30 years of experience in the power industry. We use our knowledge and experience to transform the data comparisons into insights which you can use to improve your plant. The Power Study typically identifies performance opportunities at an average of 1.5 million US dollars per 100 MW of installed capacity.

The consultants at Solomon will always start with data. These data are critical in finding performance improvements that will last. We have the team, the tools, and the proven processes to help you find the diamonds in your refinery’s and cogen’s data.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)